Wichtig

- Bevor du deine Auszahlungen sehen und konfigurieren kannst, musst du den KYC-Prozess erfolgreich abschließen. Weitere Informationen dazu findest du im Beitrag: "Know Your Customer (KYC)-Prozess".

- Wenn deine Kunden über saldiaPay bezahlen, wird das Geld nicht direkt auf dein Konto überwiesen. Das Geld wird vorerst in saldiaPay verwahrt und frühestens nach 8 Tagen ausbezahlt. Weitere Informationen dazu findest du im Abschnitt "Auszahlungsintervall".

Öffne die Ansicht "Auszahlungen"

- Öffne die Administrationsoberfläche unter login.saldiapay.ch

- Melde dich mit deinem Benutzernamen und Passwort an.

- Wähle in der Navigation den Menüpunkt "Auszahlungen".

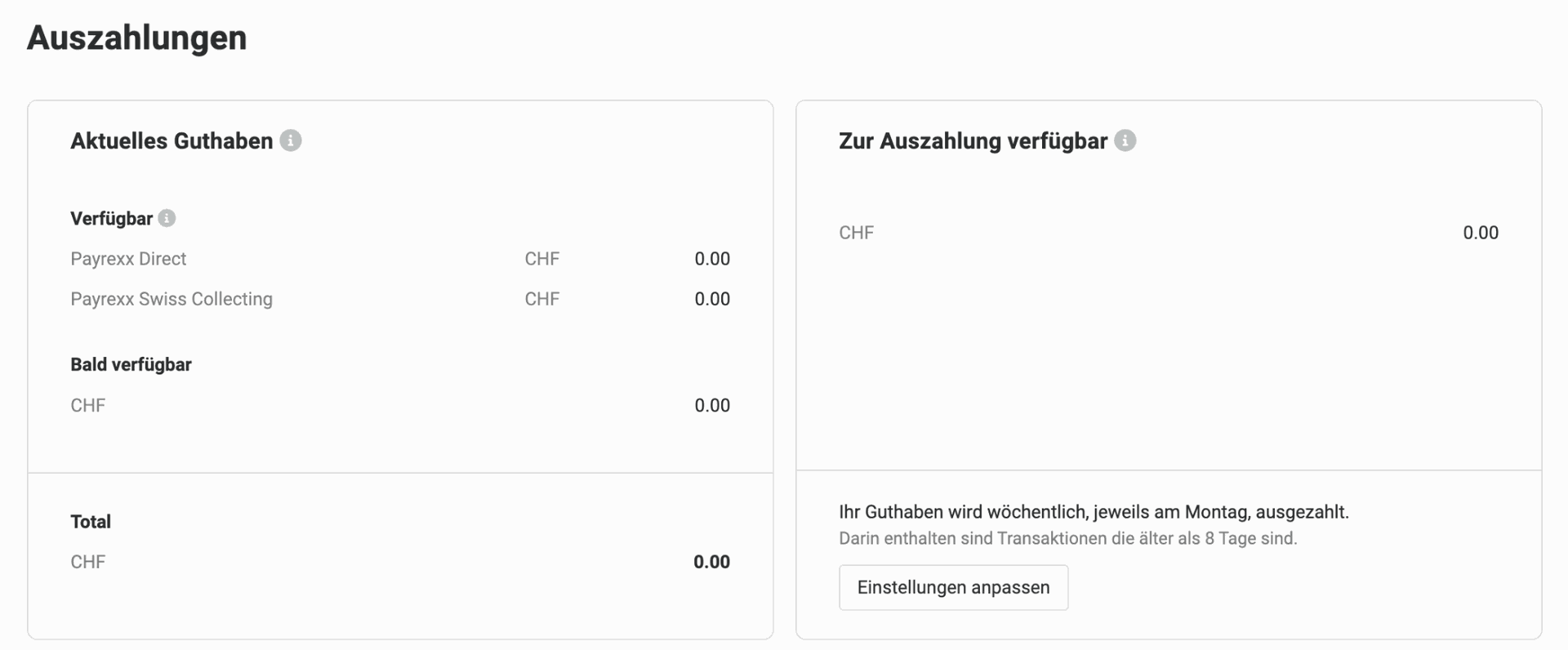

Aktuelles Guthaben

Erhalte eine Übersicht darüber, was bald ausbezahlt wird und wie viel für die nächste Auszahlung bereitsteht.

- Verfügbar: Guthaben, das unter "Verfügbar" angezeigt wird, wird zum nächsten Auszahlungszeitpunkt ausbezahlt. Grundsätzlich werden Auszahlungen immer am Ende des Monats ausgelöst.

- Bald verfügbar: Unter "Bald verfügbar" siehst du dein Guthaben, das nicht älter ist als acht Tage und somit nicht in die nächste Auszahlung einbezogen wird.

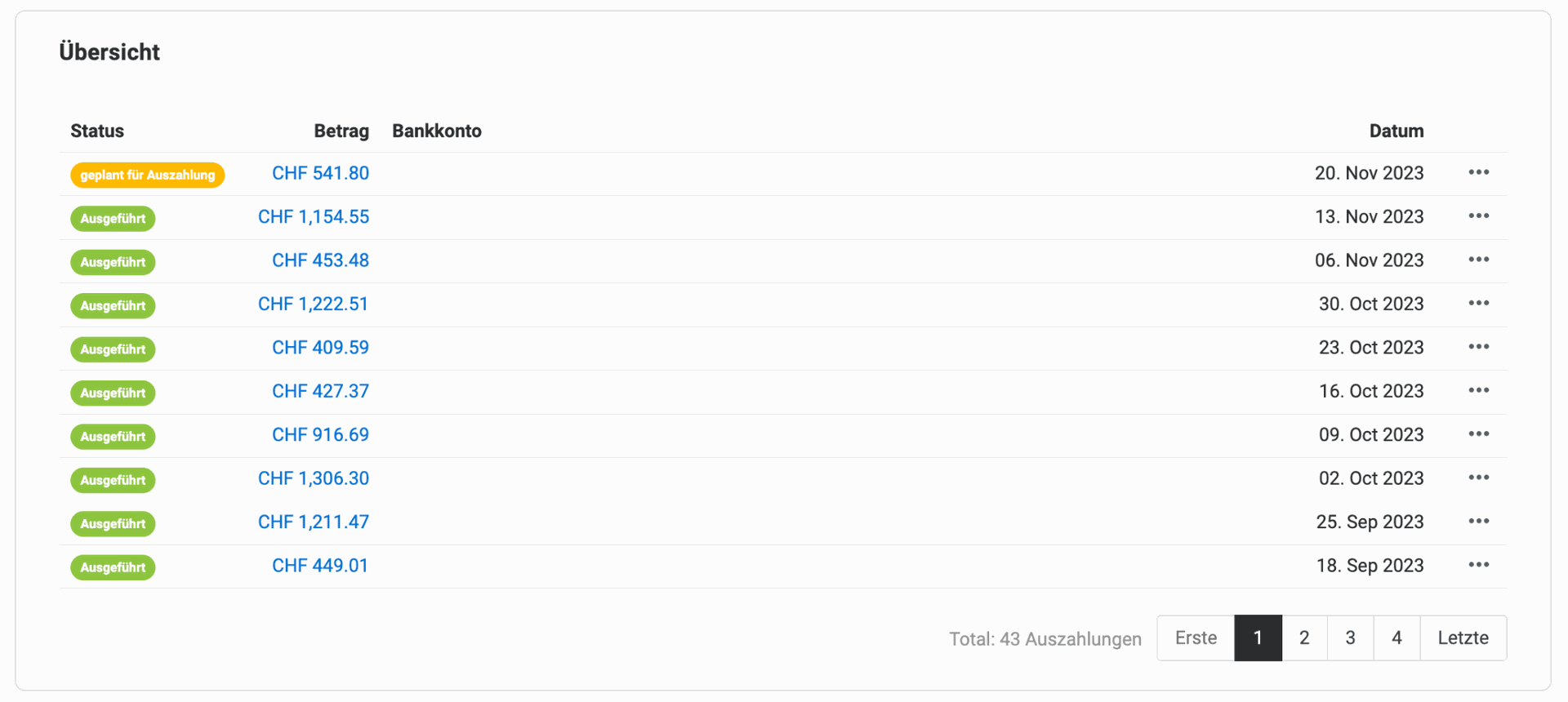

Übersicht (ausbezahlte Beiträge)

Hier sind sämtliche bereits erfolgten Auszahlungsbeträge aufgeführt. Wenn du den Mauszeiger über eine Auszahlung bewegst, erscheinen zwei Schaltflächen. Diese ermöglichen es dir, entweder die Details der Auszahlung zu öffnen oder einen Export herunterzuladen.

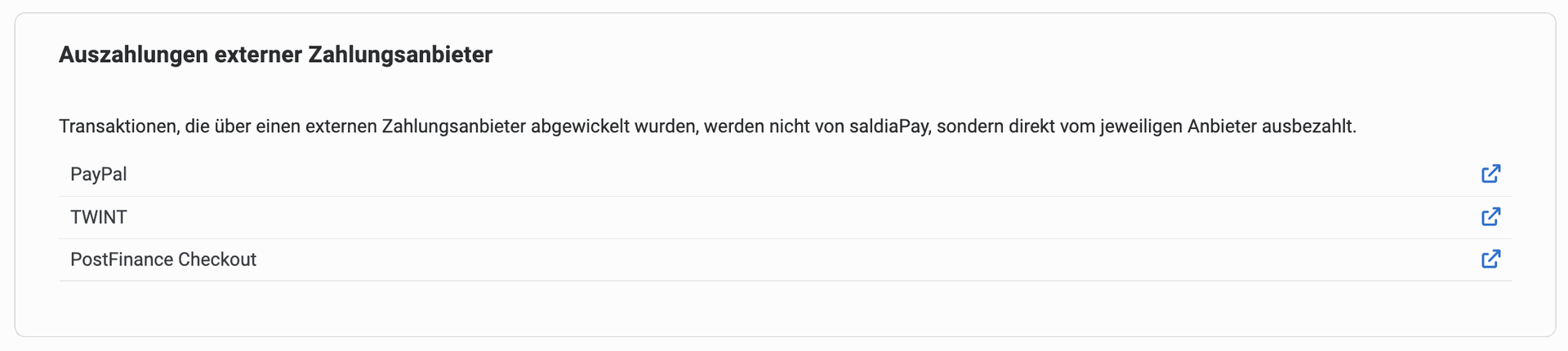

Auszahlung von externen Zahlungsanbietern

Drittanbieter-Auszahlungen werden von den verwendeten Drittanbietern vorgenommen. Wenn du Fragen zur Auszahlung von Drittanbietern hast, wende dich bitte direkt an deren Support. Auszahlungen für Drittanbieter können derzeit nicht in saldiaPay abgebildet werden.

Auszahlungsintervall

Es gibt drei Abrechnungsperioden: Täglich, Wöchentlich, Monatlich.

Wichtig:

- Standardmässig haben alle Kunden monatliche Abrechnungen. Wenn du beispielsweise aufgrund von Cashflow oder einem abonnementbasierten Geschäftsmodell eine tägliche oder wöchentliche Abrechnung wünschst, kannst du uns gerne kontaktieren. Wir passen nach Überprüfung den Auszahlungsintervall individuell für dich an.

- In den ersten drei Monaten erhältst du aus Sicherheitsgründen dein Geld jeweils am Ende des Monats. Zudem musst du bei allen Abrechnungsperioden mit rund drei Bankverzugstagen rechnen.

- 8-Tage-Regel: Bei allen Auszahlungsintervallen werden deine Transaktionen erst ausbezahlt, wenn der Erhalt mindestens 8 volle Tage zurückliegt.

Auszahlungen anpassen (Einstellungen)

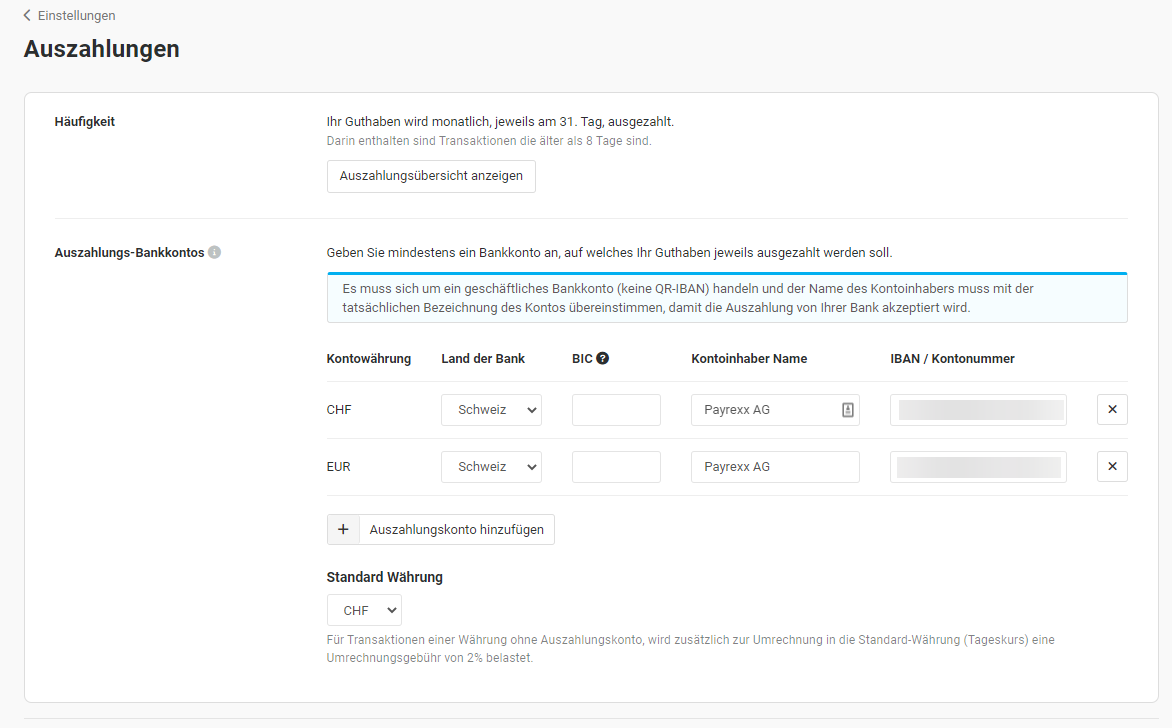

Ändere deine Kontonummer und die Währung für die Auszahlungen.

- Wähle in der Übersicht mit den Guthaben den Knopf "Einstellungen anpassen".

Bankkonten

Hier kannst du deine IBAN für Auszahlungen ändern oder ein Auszahlungskonto für Fremdwährungen angeben.

saldiaPay ermöglicht die Auszahlung in den folgenden vier Währungen. Auszahlungskonten sind nur zulässig, wenn die Währung des Kontos und das Land der Bank übereinstimmen. Die folgenden Kombinationen sind möglich:

- CHF Kontos: Schweiz, Liechtenstein

- EUR Kontos: Österreich, Belgien, Bulgarien, Schweiz, Zypern, Tschechische Republik, Deutschland, Dänemark, Estland, Spanien, Finnland, Frankreich, Vereinigtes Königreich, Gibraltar, Griechenland, Kroatien, Ungarn, Irland, Italien, Liechtenstein, Litauen, Luxemburg, Lettland, Malta, Niederlande, Norwegen, Polen, Portugal, Rumänien, Schweden, Slowenien, Slowakei

- USD Kontos: Vereinigte Staaten

- GBP Kontos: Vereinigtes Königreich, Gibraltar

Wichtig:

- QR-IBANs können nicht verwendet werden. Jede QR-IBAN hat auch eine "normale" IBAN. Wir bitten dich, die "normale" IBAN herauszusuchen und diese anzugeben.

- Bitte beachte, dass zusätzliche Gebühren für Auszahlungen anfallen können.

Mehrere Konten

Durch die Verwendung von mehreren Abrechnungswährungen kannst du als Händler:in Umrechnungskosten sparen, wenn du deine Produkte und Dienstleistungen in Ländern anbietest, die eine andere Währung als deine lokale verwenden.

Umrechnung

Transaktionen in Währungen ohne Auszahlungskonto werden in die Standardwährung umgerechnet und auf das entsprechende Konto ausgezahlt. Die Umrechnung erfolgt zum jeweiligen Tageskurs mit einer Umrechnungsgebühr von 2 %.